RBI raises rates, vows Nimble Policy

For Prelims

What is monetary policy?

- Monetary policy refers to the policy of the central bank with regard to the use of monetary instruments in order to control inflation rate in a country.

- In India monetary policy is decided by the Monetary Policy Committee (MPC).

About Monetary Policy Committee

- It was created under the recommendation of Urjit Patel Committee in 2014.

- It is a statutory institution created under the Reserve Bank of India Act, 1934, for maintaining stable rates of Inflation.

- The Governor of RBI is ex-officio Chairman of the committee.

- The MPC decides the following rates to control inflation

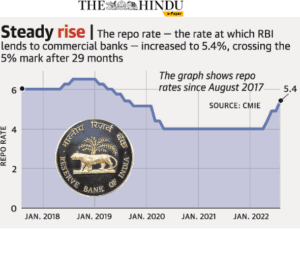

Repo Rate:

- Repo rate is the rate at which the central bank of a country (for example Reserve Bank of India) lends money to commercial banks to tide over any shortfall of funds.

Standing Deposit Facility (SDF):

- The SDF is a specialised mechanism through which the RBI can allow banks to park excess liquidity with it.

- It does not require banks to provide collateral while parking funds.

Marginal Standing Facility Rate (MSF):

- MSF is a mechanism which allows scheduled banks to borrow overnight from the RBI in an emergency situation.

Bank Rate:

- It is the rate at which the RBI lends funds to commercial banks.

Cash Reserve Ratio (CRR):

- The commercial banks have to hold a certain minimum amount of net deposit (NDTL) as liquid reserves with the central bank. This percentage is called CRR.

Statutory Liquidity Ratio (SLR):

- The minimum percentage of net deposits that a commercial bank has to maintain with themselves in the form of liquid cash, gold or other securities is called SLR.

What does “withdrawal of accommodation” stance of RBI mean?

- ‘Withdrawal of accommodation’ means that the central bank was well aware that there was too much liquidity sloshing around the system and hence will be implementing tight money policy.

Source The Hindu

For more updates, Click Here