Exports dip in the face of global uncertainity

Context:

The government is playing it safe by not declaring a specific target for outbound shipments this year and is likely to choose a variety of scenario-based targets in its place. This is due to the fact that merchandise exports shrank by 15.1% in the first quarter of this year after reaching a record $450 billion in 2022–2023.

What is the situation faced currently by the exports?

- Record Exports in 2022–23: The country set a record for merchandise exports in the preceding fiscal year (2022-23) by shipping a record $450 billion worth of goods abroad.

- In Q1 2023–24, exports declined: However, compared to the same quarter last year, exports of goods have significantly decreased in the first quarter of the current fiscal year (2023–24) by 15.1%

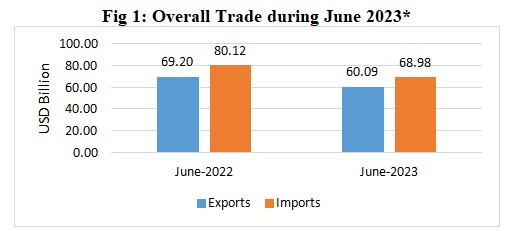

- reduction in Goods Exports: The reduction in goods exports, which slowed by 12.6% in April, 10.2% in May, and recorded a greatest fall of 22% in June 2023, is reflected in the decline in merchandise exports. The export total for June, $32.7 billion, was the lowest since October 2022.

- Services Exports growth Slows: services exports are slowing down, which is another sign of the general recession. Services exports significantly increased by nearly 28% in 2022–2023 to reach $325 billion. However, the growth in exports of services, which totalled $80 billion in the most recent fiscal year, was just 5.2%.

What are the possible causes for the decline?

- Global Economic Slowdown: A more generalized global economic slowdown may be a major factor in the drop in exports. Reduced demand for goods and services from the target country is possible if significant trading partners or areas are seeing slower economic growth.

- Trade conflicts and protectionism: policies adopted by other nations can have a negative effect on a country’s exports. It may be more difficult for exporters to enter foreign markets and compete on a global scale when there are tariffs, quotas, or other trade restrictions in place.

- Fluctuations in Commodity Prices: If the export of commodities, such as petroleum, is a major source of income for the nation, then export revenues may be considerably impacted by changes in global commodity prices. For instance, a severe decline in oil prices globally may result in a decline in petroleum exports.

- Disruptions in the supply chain: Due to natural catastrophes, logistical issues, or geopolitical events, there may be a decrease in the number of commodities that are available for export as a result of supply chain disruptions.

- Exchange rates: Changes in exchange rates might affect an exporter’s ability to compete. A country’s export demand may decline if its domestic currency is strong enough to make its goods and services substantially more expensive to international consumers.

- Domestic Economic Conditions: The nation’s general economic state might also have an impact. The performance of exports may be impacted by domestic economic difficulties like high inflation, rising production costs, or decreasing consumer demand.

- Impact of the Pandemic: The COVID-19 pandemic may still be having an impact on international trade, supply chains, and consumer demand, which may have an impact on exports.

- Gains for competitors: Increased rivalry between nations in important export markets may result in a drop in market share and a decrease in export earnings.

How is it going to affect forex and Currency valuation?

- Currency depreciation: If the drop in exports is significant and long-lasting, it may cause the demand for the nation’s currency on the forex market to diminish. The value of the currency may decline in relation to other currencies as fewer overseas purchasers require it to buy goods and services from the nation. Exports may become more competitive if the currency is lower since they will be comparably more affordable to foreign consumers.

- Inflationary Pressures: As the cost of importing goods and services rises, currency depreciation can cause imported inflation. Higher consumer costs and inflationary pressures in the economy may result from the nation’s heavy reliance on imports for some vital items.

- Trade Balance: By making exports more desirable and imports more expensive, a weaker currency might benefit the trade balance. As the value of the currency declines, the trade imbalance may decrease as imports become relatively more expensive for local consumers and exports become relatively cheaper for overseas buyers.

- Foreign Debt Burden: If a government owes a considerable amount of money in foreign currency, the cost of servicing that debt in local currency may rise as a result of currency devaluation. The government and companies that have taken on foreign debt may feel the burden as a result.

- Having an effect on foreign investment: Foreign investors may be drawn to a weaker currency because it makes domestic assets more accessible in other currencies. However, it can also reflect a lack of optimism for the nation’s economic prospects.

How to control the decline and way forward?

- Export Promotion:Implement targeted strategies for export promotion to increase export competitiveness. To get access to new trading partners, this could involve offering financial incentives, export subsidies, and support for market diversification.

- Currency Stabilization: If a currency becomes overly volatile or weak, the central bank may intervene in the foreign exchange market to stabilize it. The central bank can help maintain the value of the native currency by purchasing it on the foreign exchange market.

- Fiscal Policy: Use fiscal tools to boost domestic demand and the economy as a whole. Spending by the government on infrastructure projects and other development efforts can increase employment and stimulate the economy.

- Monetary Policies:Adjust the money supply and interest rates in the monetary system to control inflation and promote economic expansion. Lowering interest rates can boost investment and make borrowing more affordable, but it should be done with caution to prevent currency depreciation.

- Trade Policy: Review existing trade agreements and strike new ones to increase exporters’ access to markets. Improving non-tariff obstacles and streamlining trade processes can also increase export potential.