GST Council retains 28% tax on online gaming

Context:

The GST Council held firm to its earlier decision to impose a 28% levy on the full face value of bets made on online gaming, casinos, and horse racing to put it into effect on October 1 despite some technical fumbling on Wednesday.

What is the government’s stand on tax on Online Gaming?

- Tax Levy: The GST Council voted to apply a 28% Goods and Services Tax (GST) levy on the full face value of bets made on horse racing, online gambling, and casinos.

- Implementation Date: The 28% GST charge is set to go into effect on October 1st.

- Clarification on Valuation Rules: A critical clarification was provided by the Council regarding the valuation rules for the 28% levy. Finance Minister Nirmala Sitharaman explained that the tax would be levied on the entry amount alone, not on any winnings. For example, if someone enters a casino by buying chips worth ₹1,000, plays a round, and wins ₹300, the tax will not be levied on ₹1,300 (the total amount), but only on the entry amount of ₹1,000.

What was the response from the gaming industry and other states?

- Fresh Review: A new review was requested for the online gambling industry by the representative of the Delhi government. The majority of other states, on the other hand, tended to adhere to the Council’s prior decision, which was made following three years of debate.

- Industry response on online gaming: The industry of online gaming, which had voiced worries about how the ruling would affect their investments and jobs, praised the clarification of the valuation guidelines. The fact that the tax would only apply to the initial entry amount allayed their concerns about “repeat taxation,” according to this clarification.

- Dissension from Sikkim and Goa: Sikkim and Goa expressed disapproval and voiced concerns about the specifics of the levy on casino patrons.

- Impact on Tamil Nadu Ban: Tamil Nadu voiced concern over how the charge might affect the State’s ban on online gambling. The state responded by promising that the language of the new regulations would specifically declare that the tax cannot be imposed in locations where a prohibition is in effect.

What is Repeat taxation?

When the same income or transaction is subject to several taxes or levies at various stages or by various authorities within a taxation system, this is referred to as repeat taxation. This may lead to the same economic activity being taxed twice or more, which would increase the tax burden on both individuals and enterprises.

How is the new tax regime going to affect the gaming industry?

- Increased Tax Burden: The industry’s tax burden may dramatically increase if a 28% GST is imposed on the face value of bets. Businesses working in the sector may see decreased profitability as a result of this higher tax rate.

- Impact on Consumer Spending: Consumers that partake in online gaming, gambling, and horse racing may incur greater prices as a result of the higher tax rate. As a result of the increased expenses, there may be a decrease in consumer spending in the sector.

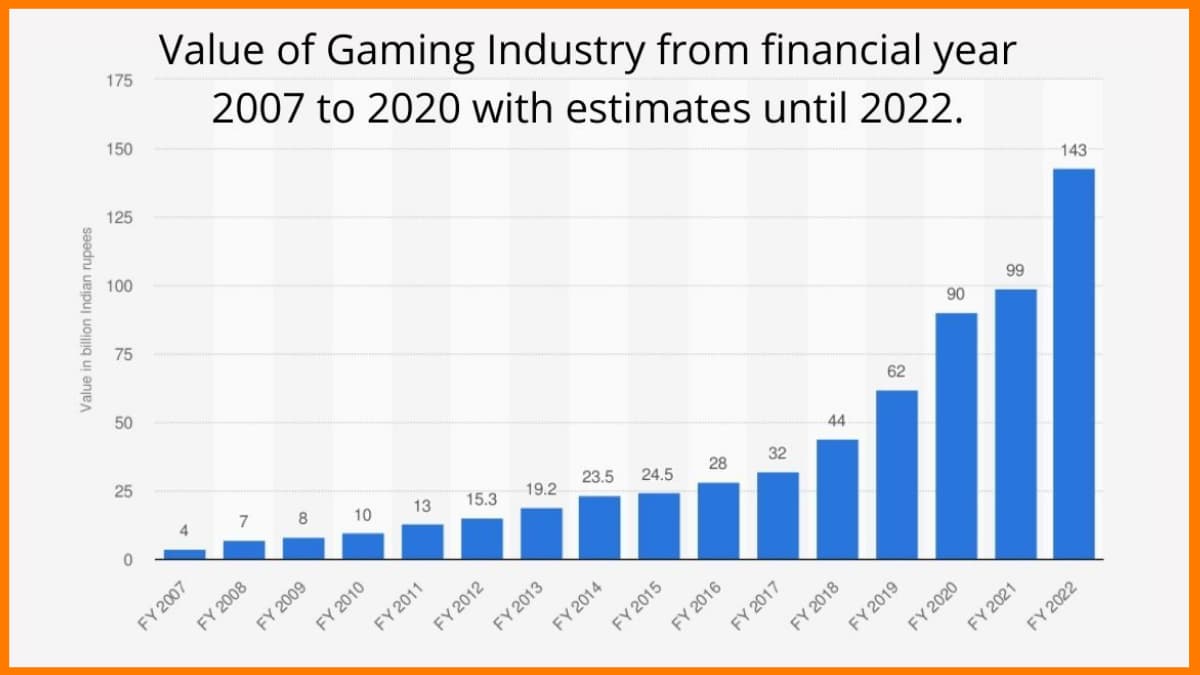

- Impact on Investments: The Indian online gaming market is regarded as a sunrise industry because it is attracting major investment and creating job possibilities. Due to the GST levy’s possible impact on profitability, more investments may not be made.

- Job Losses: If an industry has lower consumer spending and profitability as a result of higher taxes, job losses may be the result. The industry’s job prospects and growth potential could both suffer.

- State-Level Regulations: Regulations at the state level may differ depending on how some states, such as Sikkim and Goa, feel the tax should be levied and governed. The taxation system could become complicated and inconsistent between different locations as a result.

- Influence on Revenue: On the plus side, the GST levy’s introduction can bring in more money for the government, which it might put toward various public projects and services.

- Compliance Issues: Businesses in the sector may have more difficulties with compliance as a result of the adoption of the GST levy. Administrative burdens would increase as they would have to assure accurate documentation, accurate tax calculations, and timely return filing.

- Potential for the Black Market: A high tax rate can encourage the expansion of the illegal gambling industry or the black market. To escape the additional tax burden, some gamers can choose to partake in unregulated activities.

What is the way forward?

- Dialogue and advocacy: Industry participants, such as gaming businesses, trade groups, and players, should have frank discussions with the government about their concerns and the potential effects of the tax. A more balanced tax policy that promotes industrial expansion and guarantees equitable revenue collection for the government can be sought through advocacy initiatives.

- Data and Research: To demonstrate the sector’s economic and social influence, the industry can perform and provide research and data-supported studies. Building a case for a more benevolent tax treatment can be aided by demonstrating the industry’s contribution to employment, investments, and economic growth.

- Consultations at the state level: Given the opposition from some states, such as Sikkim and Goa, business representatives can meet with these governments to discuss specific issues and look into possible solutions or exclusions that would be in line with their regulatory systems.

- Efficiency and compliance: Gaming companies should concentrate on streamlining their processes to increase compliance and efficiency with the new tax laws. To avoid any non-compliance difficulties, accurate documentation, tax calculations, and timely filing of returns would be necessary.

- Support for Compliance: To ensure easy compliance with the new tax framework, the government can offer gaming companies advice and support. A better understanding of a company’s tax obligations can be achieved through clear and thorough rules.

- Review Process: It may be advantageous to implement a review process that recurrently assesses the effect of the tax on business and the economy. Based on the actual results seen, it enables tweaks or revisions to the tax policy as needed.